How to plan for retirement in your 30s

When it comes to planning for retirement, an earlier start makes it easier to attain robust investment gains and achieve the lifestyle you envision for your later years.

Your 30s are a great time to look more closely at your retirement savings options. It’s likely that your earning power is going up as debts like student loans are going down. However, you may also have new concerns such as accommodating aging parents or saving for children to go to college. Here are some realistic pointers to help you develop a plan that will deliver rewards throughout your lifetime.

How to plan for retirement in your 30s in five steps

Step 1: Set a goal for your retirement lifestyle

If you’re kicking off retirement planning in your 30s, begin with the end in mind. Do you plan to finish working at age 45, or will you work dutifully into your 70s? Do you envision vacation homes, holidays in Europe, sailboats, and exotic tourist adventures? Or will you be content with a good book, a glass of wine, and the grandkids playing in the grass — a simple picture of quiet comfort?

There’s plenty of middle ground. The end goal will determine the financial milestones you need to set along the way. It’s wise to assume you’ll need at least a decade’s worth of retirement income, with enough allotted each year to continue living the lifestyle you’re accustomed to.

Step 2: Crunch the numbers

Once you have a good bead on your goals, you can calculate what it will take to get there. The retirement calculator on NerdWallet is a great tool for eyeballing the numbers and the progress you’ll need to make. Experiment with it to see how different levels of savings, retirement ages, and life expectancies affect the final numbers.

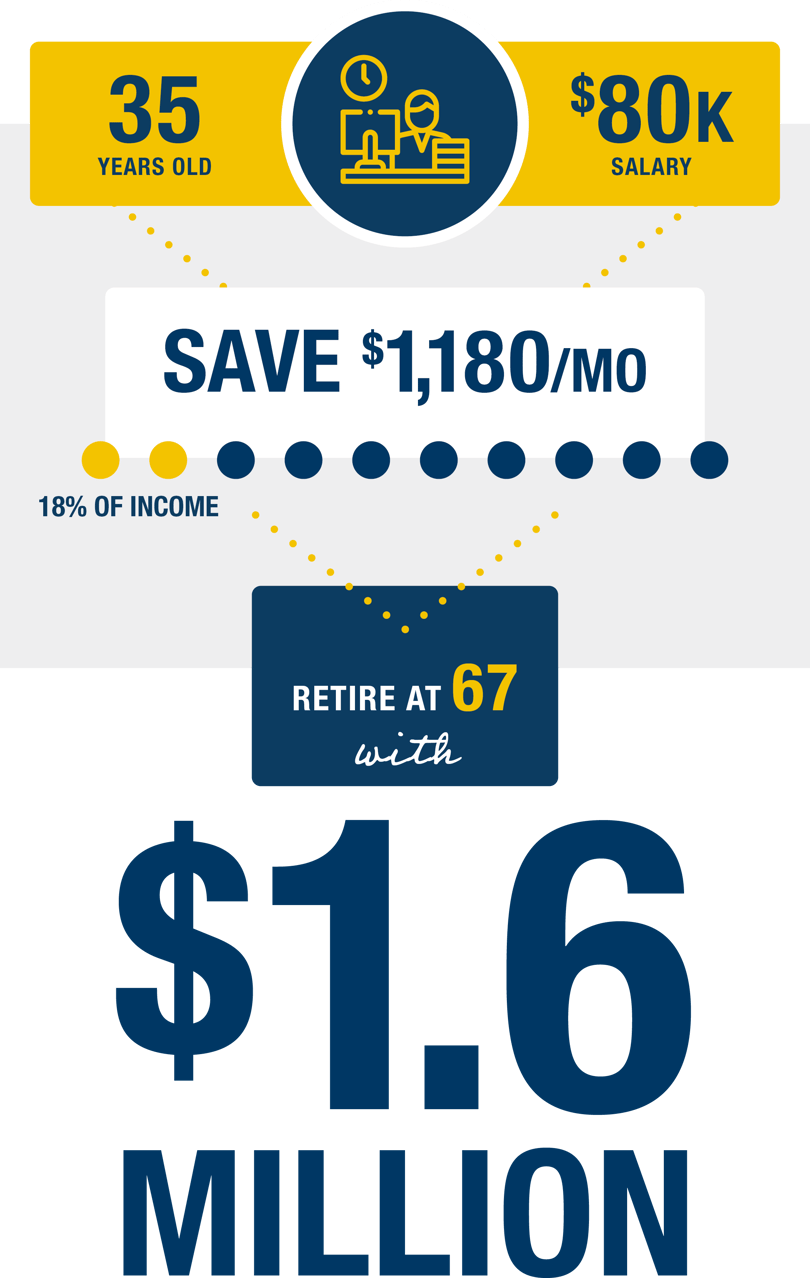

For instance, if you’re 35 years old with a pre-tax income of $80,000 and zero retirement savings so far, you would need to save $1,180 a month — 18% of your monthly income — to retire at 67 with roughly $1.62 million in the bank and maintain your current lifestyle through age 85.

This assumes 3% inflation, a 2% salary increase per year, and a 5% rate of return in retirement.

Step 3: Maximize your retirement savings

Compounding interest is a powerful thing. The more you save now, the more your money can work for you to ensure substantial returns. Consider contributing as much as possible (up to the maximum allowable amount) to retirement investment vehicles such as:

- Employer 401(k) plans — Strive to max out any employer matching contributions, but remember that saving only 3% of your salary won’t get you to your retirement goal. Go as high as you can. The 2022 contribution limit on 401(k) plans is $20,500. That won’t be realistic for everyone, but the closer you can get, the better!

- IRA or Roth IRA — There’s an annual limit on IRA savings. You can contribute up to $6,000 in 2022 if you have a modified adjusted gross income of $196,000 or less per year. If that’s a small portion of what you make, you may need additional retirement savings options. It $6,000 is a large percentage, it might be all the savings you need.

Step 4: Pay yourself first (AKA saving)

It can be trickier to decide how to plan for retirement in your 30s if you have children in the picture. You may want to save for their futures as well.

Financial advisor Tyler Huck recommends focusing on your retirement before your child’s education. As he explained to CNBC, “When you decide to retire, you just can’t go to the local bank and take a loan out. A child, if there is not enough saved for education, can go to the bank and take out a loan.”

If you have the means to save for both, consider starting a 529 plan for college and trade school expenses and contribute to it alongside your retirement savings. Rethinking your spending is the first step to saving more money. Here's a great take on 5 high-impact saving strategies from Lyn Alden Investments.

Step 5: Fill in the gaps with retirement education

We simply don’t know what we don’t know. As of 2020, only 21 states require a course in financial education during high school. That’s less than half of the U.S.! Only 6 states offer a semester-long course. This means that most adults in their 30s probably haven’t had to take any courses on financial literacy in school.

The best way to prepare for retirement and establish a strong plan is to educate yourself. Invest in your future with retirement planning courses that cover saving strategies, tax-smart investment vehicles, lifestyle planning, and more.

The Financial Educators Network offers courses on how to plan for retirement in your 30s and beyond. Learn more about our wealth creation courses here, or find a course near you.