How to plan for retirement in your 40s

It can be a struggle to consistently invest and save in your 20s — or even in your 30s. Many Americans in their 40s still aren’t sure exactly how to plan for retirement. If you worry that you don’t have a defined strategy for saving or planning your retirement income (or that you’re saving, but not enough), you’re not alone.

According to a survey by bankrate.com, one fifth of Americans between the ages of 41 and 56 want to boost their retirement savings. But there’s good news. You still have time to build a stable and secure retirement lifestyle. Here are a few tips to help you get things in order.

How to plan for retirement in your 40s in five steps

Step 1: Increase the amount you invest until it’s at least 10% of your income

Incremental increases may make it easier to work up to your investing goals. You’ve still got a good number of years left until you reach retirement, so it may be possible to increase investments by just one percentage point per year.

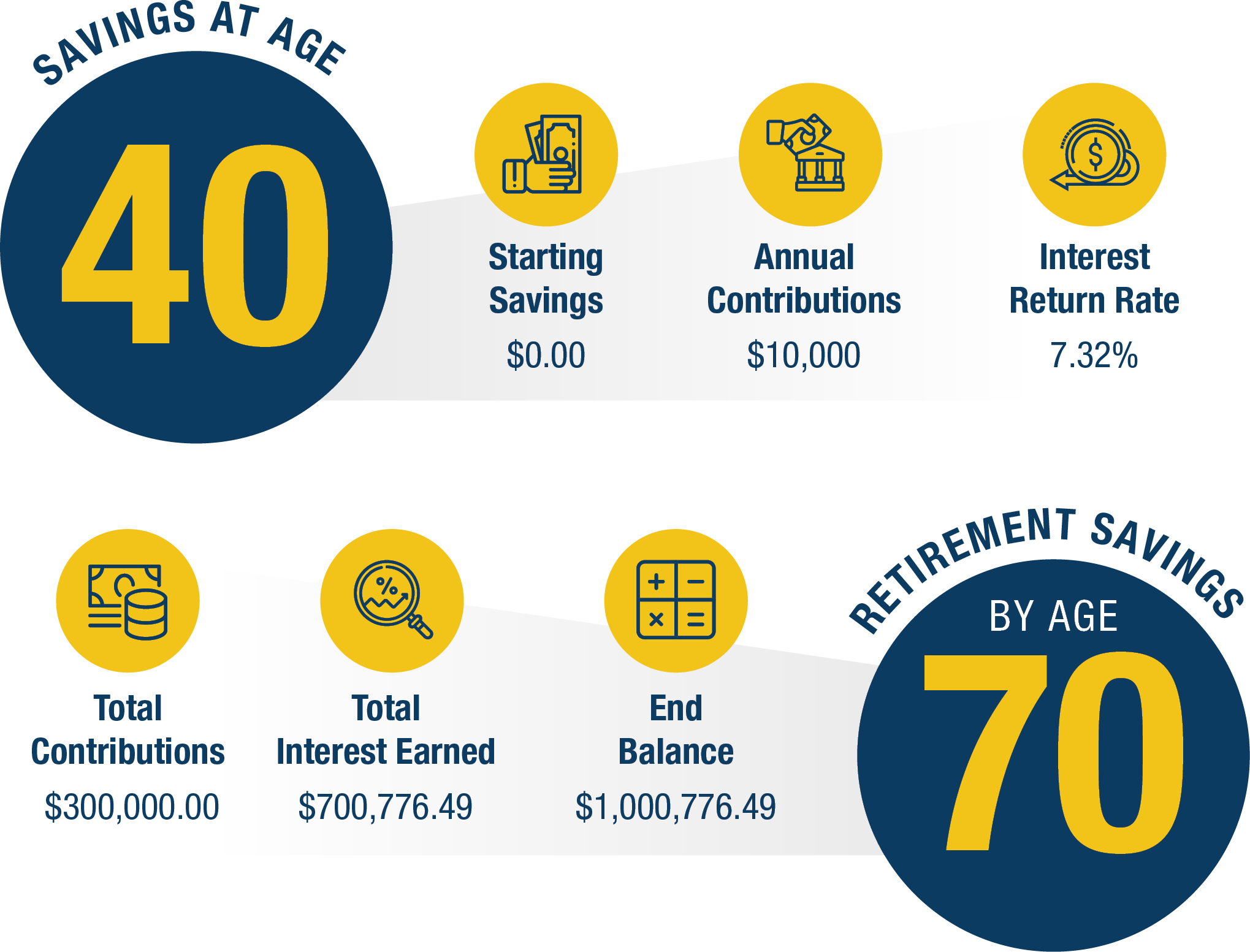

Turn salary increases into retirement investments — you’ll never notice the difference. Do what it takes to gradually invest at least 10%, or up to 20% of your income. Consistency is key. Assuming an annual return rate of 7.32%, a 40-year-old with $0 in retirement savings could start saving $10,000 per year for the next 30 years and still be able to amass $1 million in savings by age 70, despite starting with nothing saved at all.

Step 2: Maintain a balanced investment mix with reduced risk

At age 40, your investment portfolio will have less tolerance for unexpected losses than someone in their 20s or 30s. Leaning into high risk investments (to make up for lost time) could backfire. However, you’re still a long way off from retirement. Diversification is important.

Stocks are volatile, but have some of the strongest returns of your investment options. You might consider shifting some of your investments over to a more conservative asset like bonds or bond funds, which will reduce returns but also start to shield you from risk. Overall, a diverse portfolio weighted heavily towards stocks can offer the growth and security you need to achieve retirement goals.

It’s critical to find an investment advisor that you trust to help guide your investment decisions and ensure you’re leveraging an effective growth strategy. A great advisor will take the time to go over not only your stock investments, but also your 401k investment selections.

Step 3: Double-check assets, debts, and extra sources of income

It’s more common than you may think for assets like an old 401(k) to fall by the wayside, out of your attention. Take time to review everything. Have you forgotten money in a 401(k) or other benefits from a previous job? Previous work assets could be rolled into an IRA that you can invest however you choose.

Consolidating debts may free up additional money (and Wells Fargo offers a great debt consolidation calculator). As you pay off your debts, think about redirecting that money into your retirement savings. The same can go for supplemental sources of income. Before doing any new borrowing, consider the impact a major purchase may have on your cash flow and ability to save. Buying a vacation cabin can be exciting, but could it compromise the bigger picture of your retirement plans?

Step 4: Prepare for the unexpected

It’s important to keep one eye on short-term needs and one eye on the finish line as you decide how to plan for retirement. Put measures in place to protect your retirement savings from unexpected events.

For instance, staying healthy, getting exercise, and eating well now can reduce future healthcare expenses in retirement. You might also consider putting aside 3-6 months of expenses in a savings or money market account for easy access — and to keep yourself from dipping into retirement money if something short-term requires cash.

Long-term care and other insurance options should also be on your radar in your 40s. Has your homeowner’s insurance kept pace with the value of your assets? Does your employer-offered disability insurance provide sufficient coverage, or should you supplement it with a personal policy? Are you utilizing a tax-advantaged health savings account?

Proactive measures to secure your wellbeing now can ensure you’re not planning your retirement income all over again after an unexpected setback.

Step 5: Educate yourself on tax-smart solutions that will help you reach your goals

Could you make your money go farther and grow more? Are you wondering how to retire early — or if that’s even a realistic option? A financial education course can show you how to plan for retirement in your 40s with optimal, tax-smart saving strategies and budgeting solutions.

Educate yourself on how to save for retirement with a personalized retirement planning course from the Financial Educators Network. Our courses offer comprehensive retirement education with the saving techniques, investment vehicles, lifestyle planning, and other topics you’ll need to reach your retirement goals. Learn more about wealth creation in your 40s or find a course near you.